How it works

Employing people through Boundless is quick & simple.

As a Professional Employer Organisation (PEO), we take care of remote employment operations so you don't have to.

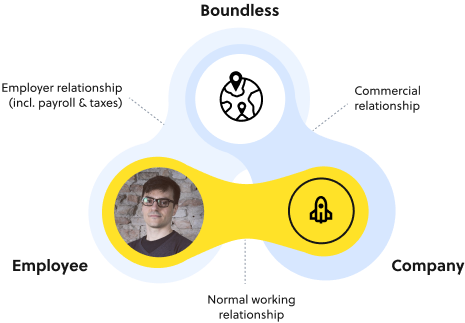

We do this through using an Employer of Record (EOR) model.

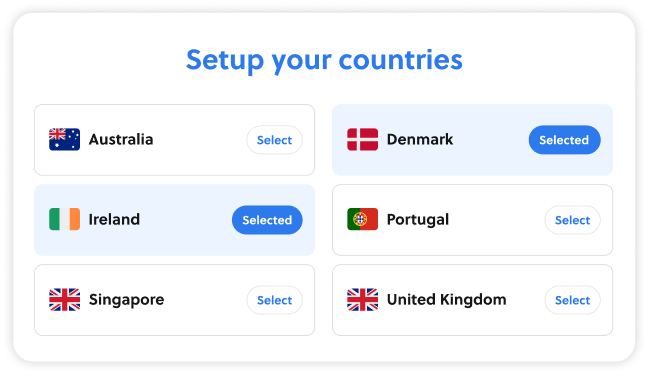

- Sign up on the Boundless platform, select which country you want to employ in, and fill out basic employee information.

- Sign the three-party employment contract between Boundless, the employee and you.

- We take care of the rest: processing payroll, filing and paying taxes, paying salaries, and managing HR compliance.

What is an EOR?

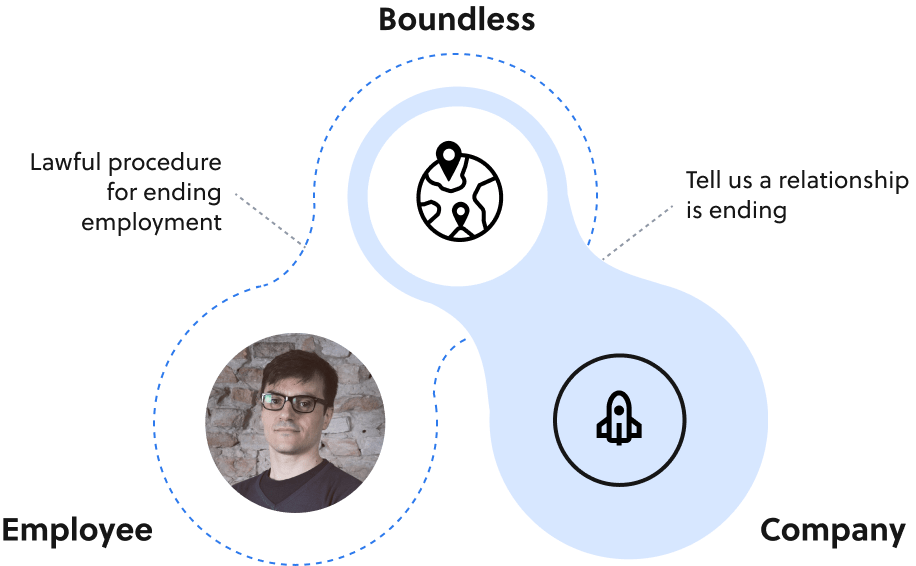

It means that Boundless is the legal employer of the individual, as far as their government, tax, and employment authorities are concerned.

We are responsible for:

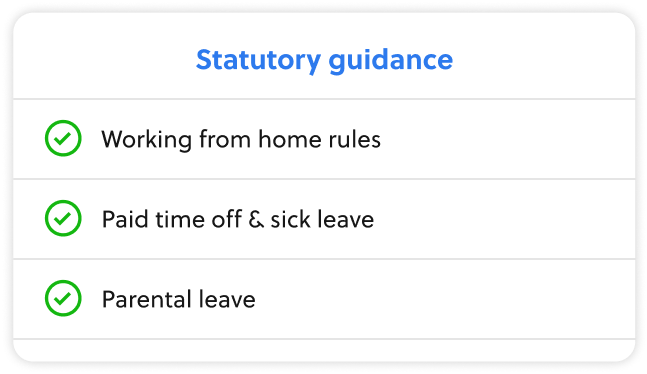

- Ensuring their employment is compliant with local employment laws

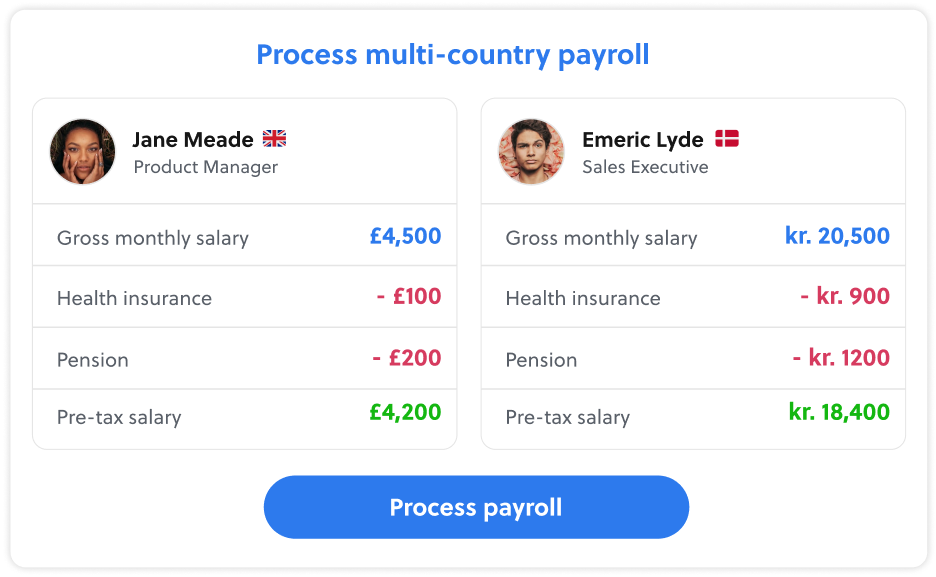

- Processing local payroll

- Filing employment related taxes and returns

- Issuing payslips to the employee

- Distributing salary payments

Why use an EOR?

Be Compliant

Employ your team in a way that benefits them, without the monthly administrative burden.

Access Local knowledge

Local expertise that can help you employ your internationally remote team in a way that's locally compliant.

Avoid Penalties

Governments are starting to enforce compliance laws that carry penalties for employee misclassification.

Scale Your Team, Faster

Take full advantage of being able to hire from a global talent pool. No waiting for you to become compliant on your own.

What about the details?

How we provide compliant international employment

How do I employ someone through Boundless?

How are employees paid?

How does the employment agreement work?

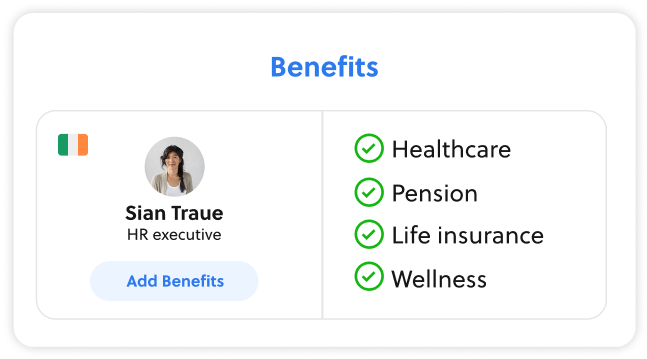

How are benefits granted to employees?

What happens if there is a problem?

How do employment relationships end?

Select the countries you want to employ people in.

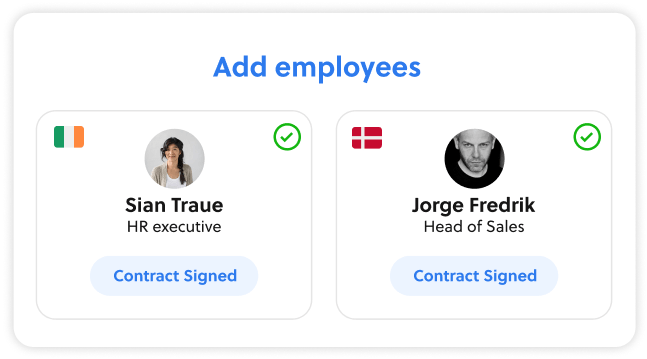

Then simply add your existing employees or new hires within the Boundless platform